Disability Tax Credit Certificate 6729 2022

What is the Disability Tax Credit Certificate 6729

The Disability Tax Credit Certificate 6729 is a form issued by the IRS that allows individuals with disabilities to claim a tax credit. This credit is designed to reduce the tax burden for those who have significant disabilities that affect their daily activities. The certificate serves as official documentation of the individual’s eligibility for the credit, which can lead to substantial savings on federal taxes. Understanding the details of this form is essential for anyone looking to benefit from the tax relief it offers.

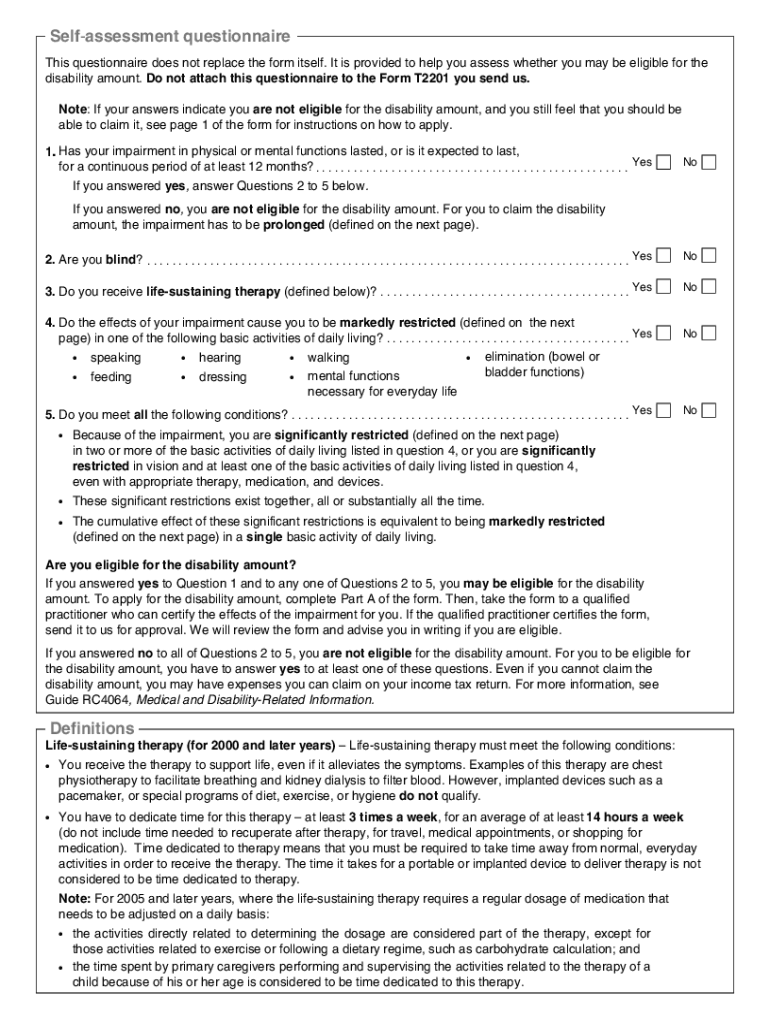

Eligibility Criteria for the Disability Tax Credit Certificate 6729

To qualify for the Disability Tax Credit Certificate 6729, individuals must meet specific eligibility criteria set by the IRS. Generally, applicants must have a severe and prolonged impairment that significantly restricts their ability to perform basic activities of daily living. This may include physical or mental disabilities. Additionally, the impairment must be certified by a qualified medical practitioner, who will complete the necessary sections of the form. It is important to gather all relevant medical documentation to support the application.

Steps to Complete the Disability Tax Credit Certificate 6729

Completing the Disability Tax Credit Certificate 6729 involves several important steps:

- Obtain the form from the IRS website or through a tax professional.

- Fill out the personal information section accurately, including your name, address, and Social Security number.

- Have a qualified medical practitioner complete the certification section, detailing the nature and extent of your disability.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS according to the specified submission methods.

How to Obtain the Disability Tax Credit Certificate 6729

To obtain the Disability Tax Credit Certificate 6729, individuals can download the form directly from the IRS website or request a copy from a tax professional. It is advisable to ensure you have the most current version of the form to avoid any issues during submission. Additionally, some tax software programs may include the form, allowing for easier completion and filing.

Form Submission Methods for the Disability Tax Credit Certificate 6729

The Disability Tax Credit Certificate 6729 can be submitted to the IRS through various methods. Individuals have the option to file the form online using e-filing software that supports the form or submit it via mail. When mailing the form, it is important to send it to the correct address specified by the IRS for tax credit claims. In-person submission is typically not available for this form.

Required Documents for the Disability Tax Credit Certificate 6729

When applying for the Disability Tax Credit Certificate 6729, several documents are necessary to support your claim. These typically include:

- A completed Disability Tax Credit Certificate 6729 form.

- Medical documentation from a qualified health care provider confirming the disability.

- Any previous tax returns that may be relevant for context.

Having these documents prepared can streamline the application process and help ensure a successful claim.

Quick guide on how to complete disability tax credit certificate 6729

Prepare Disability Tax Credit Certificate 6729 effortlessly on any gadget

Digital document management has become popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents quickly and efficiently. Manage Disability Tax Credit Certificate 6729 on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The simplest method to adjust and eSign Disability Tax Credit Certificate 6729 without hassle

- Locate Disability Tax Credit Certificate 6729 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Disability Tax Credit Certificate 6729 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct disability tax credit certificate 6729

Create this form in 5 minutes!

How to create an eSignature for the disability tax credit certificate 6729

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the disability tax credit form?

The disability tax credit form is a necessary document for individuals seeking to claim a tax exemption due to a disability. It helps in providing tax relief for those who qualify by showcasing their specific needs and challenges. Filing this form can signNowly ease financial burdens for eligible individuals.

-

How can airSlate SignNow help with the disability tax credit form?

airSlate SignNow simplifies the process of filling out and signing the disability tax credit form. Our platform allows you to easily upload your documents, fill them out, and securely eSign, making the submission process smooth and efficient. This ensures you spend less time on paperwork and more time focusing on what truly matters.

-

Is there a cost associated with using airSlate SignNow for the disability tax credit form?

Yes, airSlate SignNow offers various pricing plans to suit different user needs. Our plans are designed to be cost-effective while providing powerful features for managing documents such as the disability tax credit form. You can choose a plan that fits your budget and requirements without sacrificing quality.

-

What features does airSlate SignNow offer for the disability tax credit form?

With airSlate SignNow, users can access features like customizable templates, secure eSigning, and real-time tracking. These tools streamline the preparation and submission of the disability tax credit form, ensuring that you can manage your documents effectively and with confidence. Our features are user-friendly and designed to simplify the entire process.

-

How secure is the process of submitting the disability tax credit form via airSlate SignNow?

Security is a top priority at airSlate SignNow. We use industry-standard encryption to protect your documents, including the disability tax credit form, throughout the signing and submission process. You can trust that your sensitive information is kept safe and confidential.

-

Can I integrate airSlate SignNow with other applications for the disability tax credit form?

Absolutely! airSlate SignNow offers integrations with various applications to streamline your workflow. By connecting with other tools, you can easily manage and send the disability tax credit form alongside your other tasks, enhancing efficiency and organization.

-

What are the benefits of using airSlate SignNow for the disability tax credit form?

Utilizing airSlate SignNow for the disability tax credit form provides numerous benefits, including increased efficiency, reduced errors, and enhanced document tracking. Our platform allows you to manage your forms electronically, which not only saves time but also reduces the stress typically associated with paperwork. Experience a hassle-free way to take advantage of tax benefits!

Get more for Disability Tax Credit Certificate 6729

- Da form 3294

- Kiwisaver form 14396029

- Kentucky lien waiver form

- Pacific power landlord agreement form

- Lesson 6 skills practice surface area of prisms answer key form

- Molina of virginia appeal forms

- Maine income tax withholding business change notification form

- Declaration regarding notice for ex parte application for orders form

Find out other Disability Tax Credit Certificate 6729

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament